Public Markers

Our Temasek Review, Credit Profile, and Temasek Bonds serve as public markers for Temasek.

Jump to

The Temasek Review is our annual scorecard.

Our Credit Profile covers our key credit parameters for leverage, interest coverage, and debt service coverage. Our credit ratios facilitate a quantitative assessment of our credit quality and demonstrate our fundamental strength as an investment company.

We are rated Aaa/AAA by Moody’s Investors Service and S&P Global Ratings respectively. Ratings are an outcome of credit rating agencies’ independent assessment of Temasek’s business and financial position in accordance with their respective methodologies.

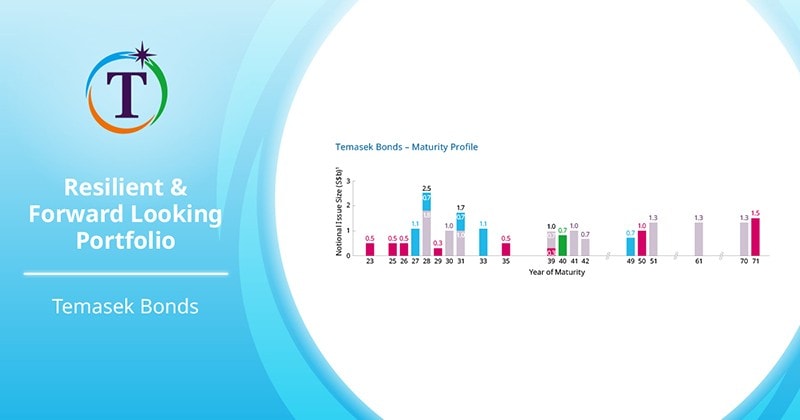

We issue Temasek Bonds and Euro-commercial Paper periodically to a diversified investor base, including retail, institutional, and accredited investors. The credit spreads of our Temasek Bonds, adjusted for any broad macro market movements, are also living public market signals of any perceived changes in Temasek’s credit quality.

Our public markers reinforce financial discipline, broaden our stakeholder base, and facilitate our communications with the wider community.